Understanding Global Economic Shifts for Stability

The global economy is a dynamic and interconnected system, constantly influenced by a myriad of factors ranging from technological advancements to geopolitical events. For individuals and businesses alike, grasping these ongoing shifts is crucial for maintaining financial stability and making informed decisions. This article explores key aspects of global economic changes and their implications for financial well-being, offering insights into how to navigate an evolving financial landscape.

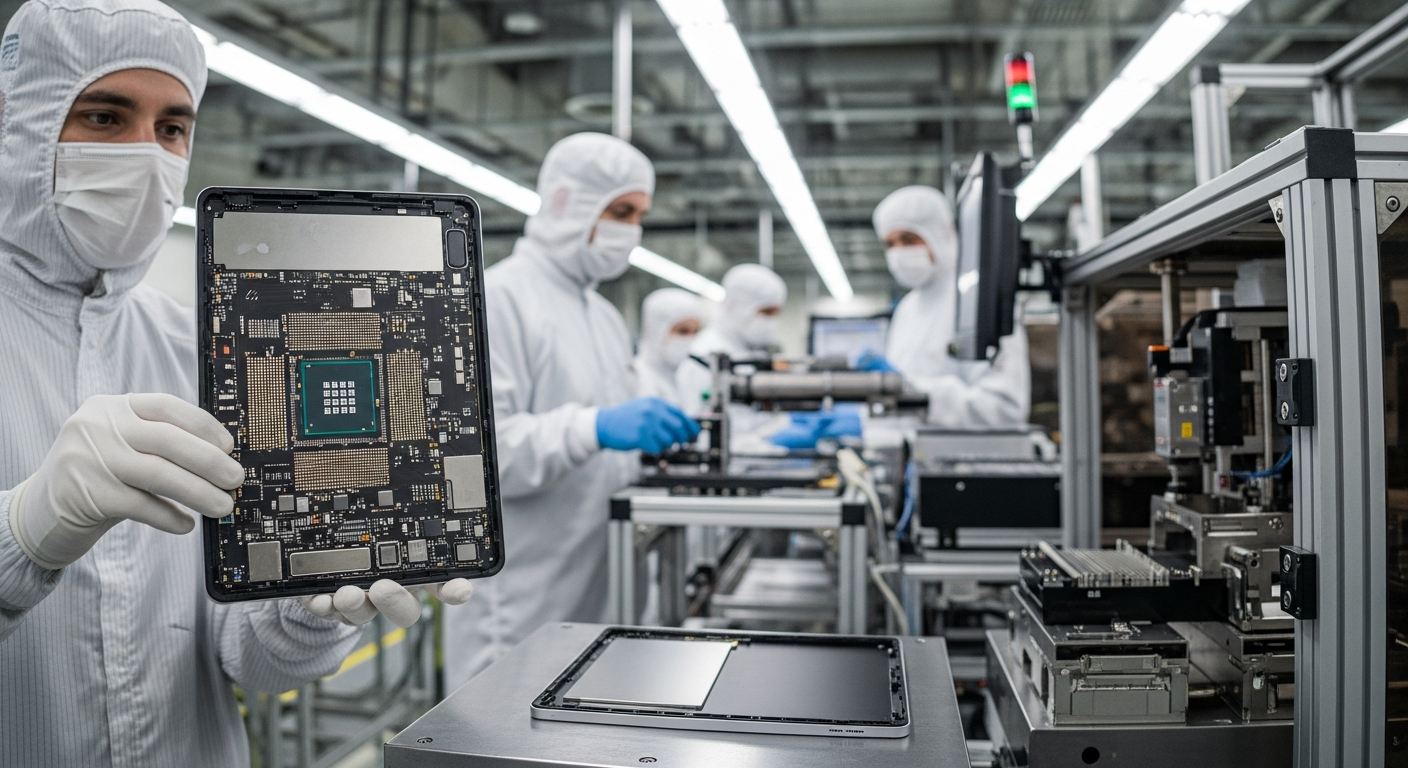

Examining Global Economic Trends and Digital Transformation

Global economic trends are shaped by a complex interplay of factors, including trade policies, technological innovation, and demographic changes. The rise of digital transformation, in particular, has reshaped industries and consumer behavior across the world. This digital shift impacts everything from supply chains to payment systems, influencing economic growth patterns and creating new avenues for investment. Understanding these broad trends is fundamental for anyone seeking to make strategic financial planning decisions in a modern context.

Strategic Investment and Wealth Management in Changing Markets

Navigating financial markets requires a strategic approach, especially when global economic shifts introduce new variables. Effective investment strategies involve diversifying assets across various classes and geographical regions to mitigate risk. Wealth management, in this context, extends beyond mere asset allocation to encompass comprehensive financial planning, including long-term growth objectives and wealth preservation. Adapting to market volatility and understanding the interplay of global capital flows are key components of a robust financial strategy.

The Role of Policy, Banking, and Financial Security

Monetary and fiscal policy decisions made by central banks and governments significantly influence the global economy. These policies can affect interest rates, inflation, and currency values, impacting everything from personal savings to corporate banking operations. Ensuring financial security involves not only understanding these policy impacts but also engaging with reliable financial institutions. Digital banking solutions offer convenience, but they also highlight the importance of robust cybersecurity measures to protect assets and personal information.

Managing Financial Risk and Budgeting for Stability

Every financial endeavor carries an element of risk, and global economic shifts can amplify these uncertainties. Effective risk management involves identifying potential threats to financial stability, such as market downturns or unexpected expenses, and developing mitigation strategies. For individuals, sound budgeting practices are essential for managing personal funds, ensuring that expenses do not outweigh income, and building an emergency savings buffer. Businesses, too, must maintain vigilant budget management to sustain operations and capitalize on growth opportunities.

Financial Planning for Sustainable Growth and Future Assets

Long-term financial planning is crucial for achieving sustainable growth and accumulating assets over time. This involves setting clear financial goals, such as retirement savings or significant purchases, and systematically working towards them. Diversification of assets, including real estate, stocks, bonds, and alternative investments, can help spread risk and enhance potential returns. Regular review and adjustment of financial plans are necessary to adapt to personal circumstances and evolving global economic conditions.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Financial Advisory | Independent Advisors | Hourly rates: $100-$300; AUM fees: 0.5%-1.5% |

| Online Brokerage | Interactive Brokers | Commission-free stock/ETF trading, margin rates vary |

| Robo-Advisor | Betterment | Management fees: 0.25%-0.40% AUM |

| Wealth Management | Major Banks/Firms | AUM fees: 0.75%-2.0% (tiered) |

| Personal Budgeting Tools | YNAB (You Need A Budget) | $14.99/month or $98.99/year |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

In conclusion, navigating the complexities of global economic shifts requires a proactive and informed approach. By understanding key trends, adopting strategic investment and wealth management practices, recognizing the impact of policy and banking, and diligently managing risk and budgeting, individuals and organizations can enhance their financial stability. Continuous learning and adaptation are vital for thriving in an ever-changing global financial landscape.